FBR Salary Records

Contents

- 1 FBR Salary Records: An Important Notice for Government Employees

- 1.1 Your Salary Records Are Now on IRIS: An Important Notice for Government Employees

- 1.2 What is the FBR’s IRIS System?

- 1.3 Step-by-Step Guide to Checking Your Salary Record

- 1.4 Common Discrepancies to Look For

- 1.5 Frequently Asked Questions (FAQs)

- 1.5.1 What is the IRIS system and why is it important for my tax return?

- 1.5.2 How can I register for an FBR IRIS account if I don’t have one?

- 1.5.3 I found an error in my FBR salary records. What should I do?

- 1.5.4 Is it mandatory for government employees to check their FBR salary records?

- 1.5.5 What is the deadline to check my FBR salary information?

- 1.5.6 What is the IRIS 2025 return?

- 1.5.7 Are all government employees’ salary records loaded in the IRIS system?

- 1.6 Final Thoughts

FBR Salary Records: An Important Notice for Government Employees

An important notice for government employees regarding FBR salary records loaded into the IRIS system. Learn how to log in, check details, and correct errors.

Your Salary Records Are Now on IRIS: An Important Notice for Government Employees

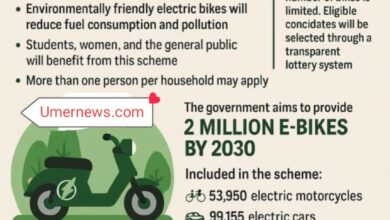

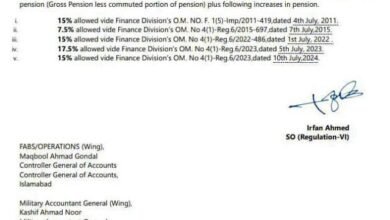

Attention to all government employees! The Federal Board of Revenue (FBR) has made a significant update that directly affects your annual tax return process. The salary records of government employees have been loaded into the IRIS system for the 2025 return. This is an important notice for government employees everywhere, as you can now access and view your salary details directly in your account.

This new system aims to simplify the tax filing process by providing pre-filled data, but it also places a critical responsibility on you: to verify the information. In the past, manually entering every detail was a tedious process, often leading to mistakes. Now, with the data pre-loaded by FBR, you must log in and check your salary information immediately. Identifying and correcting any errors or omissions in a timely manner is crucial to ensure accuracy in your tax filings and avoid future complications.

What is the FBR’s IRIS System?

The IRIS system is an online tax administration portal managed by the Federal Board of Revenue. It serves as a one-stop-shop for taxpayers to file returns, access tax information, and manage their tax profiles. The system is designed to streamline tax processes and promote transparency. By pre-loading salary data, the FBR is taking a major step towards making tax returns more efficient for government employees. This update is specifically for the 2025 return.

Why You Must Check Your IRIS Account Now

Ignoring this update could lead to serious problems with your tax returns. Incorrect salary information can lead to overpayment or underpayment of taxes, which could result in penalties or audits later on. Verifying your details ensures that your tax calculations are based on accurate data from the start.

- Pre-filled data isn’t always perfect: While the FBR aims for accuracy, data entry errors or discrepancies from your employer’s end can still occur.

- Avoid future complications: Catching a mistake now is far easier than trying to rectify it after the tax filing deadline has passed.

- Ensure correct tax calculations: Your tax liability is determined by your income. Correct salary details are fundamental to an accurate tax assessment.

Step-by-Step Guide to Checking Your Salary Record

Accessing your salary details in the IRIS system is straightforward. Follow these steps to log in and verify your information:

- Log in to your IRIS account: Visit the official FBR IRIS portal and enter your credentials (CNIC and password). If you don’t have an account, you will need to register.

- Navigate to the relevant section: Look for the “2025 Return” section. Within this area, there should be a link or tab for “Salary details” or “Pre-filled data.”

- Review the information: Carefully check the pre-loaded data against your salary slips or bank statements. Pay attention to your total salary, allowances, and any deductions.

- Report discrepancies: If you find any errors, contact your departmental drawing and disbursing officer (DDO) or a tax consultant immediately to get the issue resolved.

Common Discrepancies to Look For

When you check your FBR salary records, here are some of the most common issues to look out for:

| Type of Discrepancy | What to Check | Why It’s Important |

| Incorrect Total Salary | Does the figure match your total earnings for the year? | Affects your tax bracket and total tax liability. |

| Missing Allowances/Bonuses | Were any special allowances or bonuses you received not included? | These are taxable and must be reported accurately. |

| Wrong Deductions | Are all your tax deductions (e.g., from provident fund) correctly listed? | Incorrect deductions can lead to overpayment of taxes. |

Frequently Asked Questions (FAQs)

What is the IRIS system and why is it important for my tax return?

The IRIS system is the Federal Board of Revenue’s online portal for tax administration. It’s crucial for your tax return as it allows you to file, check your tax profile, and now, verify your pre-loaded salary records for the 2025 tax year.

How can I register for an FBR IRIS account if I don’t have one?

To register for an FBR IRIS account, you’ll need to visit the FBR’s website and follow the registration process. It typically requires your CNIC number, a valid email address, and a mobile phone number to create a new account.

I found an error in my FBR salary records. What should I do?

If you find a discrepancy in your FBR salary records, you should contact your department’s Drawing and Disbursing Officer (DDO) immediately. They are responsible for providing the correct data to the FBR and can help in rectifying the error.

Is it mandatory for government employees to check their FBR salary records?

Yes, it is highly recommended and practically mandatory to check your salary records. While the data is pre-loaded, it is your legal responsibility as a taxpayer to ensure the accuracy of all information submitted in your tax return to the FBR.

What is the deadline to check my FBR salary information?

The FBR has advised that government employees should check their salary details in a timely manner. While there isn’t a specific separate deadline for this action, it’s best to do it well before the tax return filing deadline to allow time for any corrections.

What is the IRIS 2025 return?

The IRIS 2025 return refers to the tax return for the tax year 2025. It’s the specific section on the IRIS portal where taxpayers, including government employees, will file their annual income tax returns based on their income from the fiscal year ending in 2025.

Are all government employees’ salary records loaded in the IRIS system?

According to the FBR, the salary records for most government employees have been loaded into the IRIS system. It is still essential for every employee to log in and confirm that their specific data is present and accurate for the 2025 return.

Final Thoughts

The FBR’s move to pre-load salary records into the IRIS system is a welcome change that simplifies the tax filing process for many. However, the responsibility to verify this information lies with you. Take a few minutes to log in, check your salary details, and ensure everything is accurate for your 2025 return. This simple step can save you a lot of time and potential headaches down the road. This important notice for government employees is all about proactive tax management.

Don’t wait for the last minute! Log in to your IRIS account today. If you found this information helpful, please share it with your colleagues to ensure everyone is aware of this critical update.

اہم اطلاع برائے سرکاری ملازمین

فیڈرل بورڈ آف ریونیو (FBR) نے سرکاری ملازمین کی تنخواہوں کا ریکارڈ IRIS سسٹم میں لوڈ کر دیا ہے۔ اب تمام ملازمین اپنی تنخواہوں کی تفصیلات براہ راست IRIS اکاؤنٹ کے ذریعے 2025 کی ریٹرن میں دیکھ سکتے ہیں۔

برائے مہربانی اپنا لاگ اِن کریں اور معلومات کو چیک کر لیں تاکہ کسی بھی قسم کی غلطی یا کمی بیشی کی صورت میں بروقت درستگی کروائی جا سکے۔