Pakistan Government’s Flood Relief Initiative

Pakistan Government’s Flood Relief Initiative

Pakistan Government’s Flood Relief Initiative: How Salary Deductions Are Helping

Learn how the Pakistan government is mobilizing funds for flood relief through salary deductions from federal employees. Discover the details of the Prime Minister’s Relief Fund.

Recent monsoon rains have caused devastating floods across Pakistan, leading to significant damage and a humanitarian crisis. In response to this urgent situation, the Government of Pakistan has initiated a national effort to provide relief and rehabilitation to those affected. A key part of this effort involves a direct contribution from government employees themselves, as detailed in a recent official memorandum. This initiative, which includes the deduction of salary for Pakistan government employees, is a direct and impactful way to support the Prime Minister’s Relief Fund for Flood, Earthquake, and Other Calamities.

Understanding the Government’s Call to Action

To meet the challenge of providing relief, the Finance Division has created a dedicated fund. The official document outlines specific contributions from different tiers of the federal government:

- Cabinet Members are directed to contribute one month’s salary to the Prime Minister’s Relief Fund.

- Federal Bureaucracy Employees from BPS-19 to BPS-22 will donate one day’s salary.

This measure ensures a broad and collective effort from within the government to directly support the relief operations. It’s a clear move to show solidarity and provide immediate financial assistance where it is needed most.

The Prime Minister’s Relief Fund: A Lifeline for Affected Communities

The money collected through these salary deductions is being credited to a specific public account titled “Prime Minister’s Relief Fund for Flood, Earthquake and other Calamities.” This dedicated account ensures that all contributions are channeled transparently for the purpose of helping victims of natural disasters.

The funds will be used for:

- Rehabilitation of damaged infrastructure

- Provision of aid to affected individuals and families

- Medical assistance and support for casualties

- Long-term recovery projects in flood-hit areas

The focus is on providing swift relief and supporting the long-term rebuilding process. The decision to deduct salaries is a proactive step to ensure a consistent flow of funds to the relief efforts.

How the Deductions Are Handled

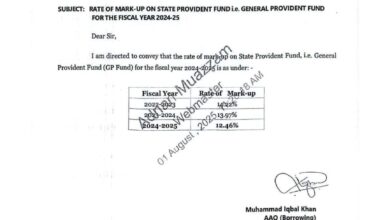

The memorandum clarifies that the amount contributed will be a deduction from the employees’ gross pay and allowances before any other deductions. This is an important detail as it ensures the contribution is calculated on the full salary and is a significant amount. However, the document also specifies that these deductions will not be included in the emoluments for the calculation of income tax or the recovery of House Rent Charges, providing a clear financial guideline for the process. This helps simplify the accounting and ensures the process is transparent.

A Collective Effort for a National Cause

This initiative highlights the commitment of the Pakistan government and its employees to stand with their fellow citizens during a time of crisis. By directly contributing a portion of their earnings, they are playing a direct role in the national recovery and rehabilitation efforts. The deduction of salary for Pakistan government employees serves as a powerful example of collective responsibility and unity in the face of a calamity. This is not just a policy directive; it’s a demonstration of solidarity and a commitment to helping those most vulnerable.

Conclusion

The salary deductions for the Prime Minister’s Relief Fund are a crucial part of Pakistan’s response to the devastating floods. This effort, driven by the government itself, provides a structured and transparent way for federal employees to contribute directly to the relief and rehabilitation of affected communities. The initiative is a powerful step towards ensuring that help reaches those who need it most, demonstrating a national commitment to overcoming this natural disaster.

Do you have any thoughts on this initiative or other ways people can contribute to disaster relief? Share your ideas in the comments below.

FAQ

Q1: What is the purpose of the Prime Minister’s Relief Fund?

The Prime Minister’s Relief Fund is a dedicated public account established by the Government of Pakistan to collect donations for victims of natural disasters such as floods, earthquakes, and other calamities. Its purpose is to provide immediate and long-term financial assistance for relief and rehabilitation efforts.

Q2: Who is contributing to the fund through salary deductions?

According to the official memo, Cabinet members are contributing one month’s salary, while federal bureaucracy employees from BPS-19 to BPS-22 are contributing one day’s salary. This initiative aims for a broad contribution from within the government.

Q3: How much salary is being deducted?

The amount being deducted is either one month’s salary for Cabinet members or one day’s salary for federal bureaucracy employees (BPS-19 to BPS-22). The deduction is based on the gross pay and allowances.

Q4: Will this deduction affect my income tax?

No. The official memorandum specifies that the contributed amount will not be included in the emoluments for the calculation of income tax, nor for the recovery of House Rent Charges. This ensures the contribution is handled separately for tax purposes.

Q5: Is this a mandatory deduction for all federal employees?

The memorandum directs that Cabinet members and federal bureaucracy employees (BPS-19 to BPS-22) will have their salaries deducted. The document is an official directive for the implementation of this decision.

Q6: Where do the funds go?

All proceeds from the salary deductions are being credited to a specific public account under the head of G12164 – “Prime Minister’s Relief Fund for Flood, Earthquake and other Calamities.” This ensures a clear and direct channel for the funds.

Q7: Can I contribute to this fund if I am not a government employee?

While the memo specifically details salary deductions for federal employees, the Prime Minister’s Relief Fund is generally open to donations from the public. You can find information on how to contribute on official government websites or through banking channels.